When you’re inserting a market buy order, it would fill at the lowest accessible ask value. The bid-ask spread is the distinction between the highest buy order (bid) and the lowest promote order (ask) for a given market. The bid-ask spread can be considered as a measure of supply and demand for a given asset. The smaller the bid-ask unfold is, the more liquid the market is. If you’d wish to learn more about how to draw trend strains, check out Trend Lines Explained. Typically, the more instances the price has touched (tested) a development line, the extra dependable it could also be considered. Typically, traders will pick two vital worth factors on a chart, and pin the 0 and 100 values of the Fib Retracement tool to these factors. Technical indicators, comparable to trend traces, moving averages, Bollinger Bands, Ichimoku Clouds, and Fibonacci Retracement can also suggest potential help and resistance levels.

Another side to think about right here is the energy of a development line. The typical definition of a pattern line defines that it has to touch the value a minimum of two or 3 times to develop into valid. What is https://Bitcoinxxo.com ? Others might use them to create actionable commerce concepts based on how the pattern strains interact with the price. Our Factory of China Caps,with developing business opportunities since 2004, supplies over 3,000 retailing stores in home market, strives to offer prospects with quality merchandise as pretty competitive price with immediate delivery and dependable companies. As per the necessity of the businesses we offer 3 totally different engagement models as effectively. In addition to affordable automobile finance, we provide personal and business automotive leasing which allows you to decide on your perfect automobile at a versatile and economical month-to-month price. Andrej was a pleasure to work with and is always looking for ways to provide himself with private growth. Candlestick chart evaluation is certainly one of the most typical ways to look on the Bitcoin market using technical evaluation.

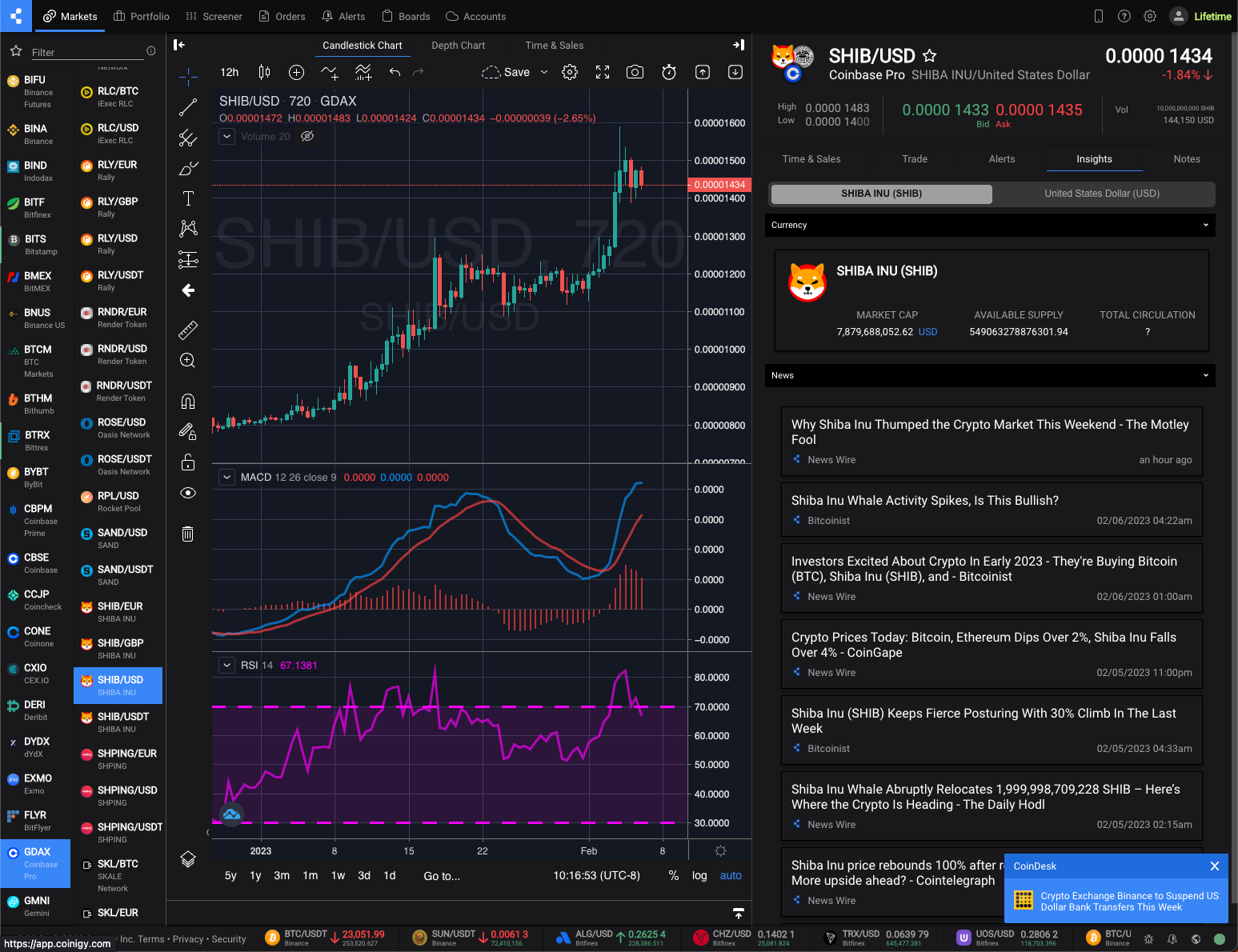

Daily chart of Bitcoin. Bitcoin is below $29,500 when paired with the US Dollar. However, to be able to make that selection, they needed to find out about them first - and that’s what we’re going to do on this chapter. The Open and Close are the first and final recorded value for the given timeframe, whereas the Low and High are the bottom and highest recorded price, respectively. This calculation will be based mostly on price, quantity, on-chain data, open interest, social metrics, or even one other indicator. So, which is one of the best technical analysis indicator on the market? There are additionally sorts of indicators that goal to measure a selected side of the market, such as momentum indicators. Some traders may draw development strains on technical indicators and oscillators. As such, candlestick patterns are widely utilized by Forex and cryptocurrency traders alike. Candlestick patterns are also a fantastic method to handle risk, as they'll present commerce setups which might be outlined and precise. This allows traders to give you very precise and controlled trade setups. As such, traders who use technical analysis might use an array of technical indicators to determine potential entry and exit points on a chart.

Some traders might solely use development strains to get a greater understanding of the market construction. Trend lines can be utilized to a chart displaying just about any time-frame. They're traces that connect sure knowledge points on a chart. Candlestick charts are certainly one of a very powerful instruments for analyzing financial data. A candlestick is made up of 4 data factors: the Open, High, Low, and Close (also referred to as the OHLC values). If you’d like to discover ways to learn them, check out 12 Popular Candlestick Patterns Utilized in Technical Analysis and A Beginner’s Guide to Classical Chart Patterns. Would you like to learn how to read candlestick charts? Check out A Beginner’s Guide to Candlestick Charts. Some of the most common candlestick patterns embody flags, triangles, wedges, hammers, stars, and Doji formations. As we’ve mentioned earlier, technical analysts base their strategies on the assumption that historic price patterns may dictate future price movements. As a front-finish consultant I helped the crew to assessment the existing code base and refactor problematic flows, fix varied bugs and issues. In case your account fails this assessment course of you may want to instead use this method of shopping for Gala on Binance.